Vietnamese

Vietnamese

‘More than shopping’: The future of retail in a post-COVID world

Forget shops as “essential services”. Retailers are now talking about creating “holistic experiences” in beautiful spaces that people want to visit.

GPT Group’s head of retail Chris Barnett says that while there was an uptick in online shopping during pandemic lockdowns, customers have returned to stores almost to the same levels as before the pandemic.

“What we were very happy to see was that when our centres were able to open and freely trade after lockdown, there was a flood back into our centres,” he said.

But the retailers that had done especially well were the “omni-channel” retailers — those with strong online and bricks-and-mortar options.

Chris Barnett, head of retail at GPT. Photo: Supplied

“We need to create destinations that really enrich people’s experiences, not only just to come and shop for necessities, daily needs and food,” he said. “Shopping centres, they now need to evolve into places where people live, people work, people exercise, people dine, an holistic offer.”

Charles Hinckfuss, the founder of lifestyle luxury brand MCM House, which has a flagship store on Sydney’s Oxford Street, and says space is especially important for furniture retailers.

“The presence of a window, the space to light, the feeling that someone gets when they walk around furniture needs to be an elevated experience,” he said. “Because of that, it was really important with MCM that we really search for iconic Sydney buildings that elevated the aspirational feeling of owning furniture, even at an affordable rate.”

And the importance of space has only increased with the rise of online shopping, Mr Hinckfuss says.

“Attracting customers into your shop is going to be more and more important as online and the use of your phone in your hand on a minute-by-minute daily basis, it’s really important that retail in itself is considered a theatre, whether it’s art, whether it’s food, whether it’s music, combined with your product. It’s really important that as a retail and a business owner, that I try and incorporate more attraction to the site other than the product itself.”

Charles Hinckfuss, founder of MCM House.

Head to the regions

With a keen interest in the use of space in retail, Mr Hinckfuss said he’d noticed a change in the way retailers were using their properties.

“I really saw the acceleration of this during the recent pandemic where there were some fantastic hubs that were created in regional areas primarily,” he said. “They really mixed a lot of diverse buildings and businesses together.”

The Byron Bay industrial estate was one project in particular he’s noticed, which is a true mixed-used precinct with childcare, breweries, offices and retail.

With an uptick in people moving to regional areas during the pandemic, there has also been an increase in many regional areas’ retail property supply and demand.

There has been a 217 per cent increase in interest in retail properties in Byron Bay (to lease and buy) in the first quarter of 2021, compared with the same period last year, according to Commercial Real Estate internal data.

And, other regional areas around Australia have seen a similarly huge increase in demand for retail space.

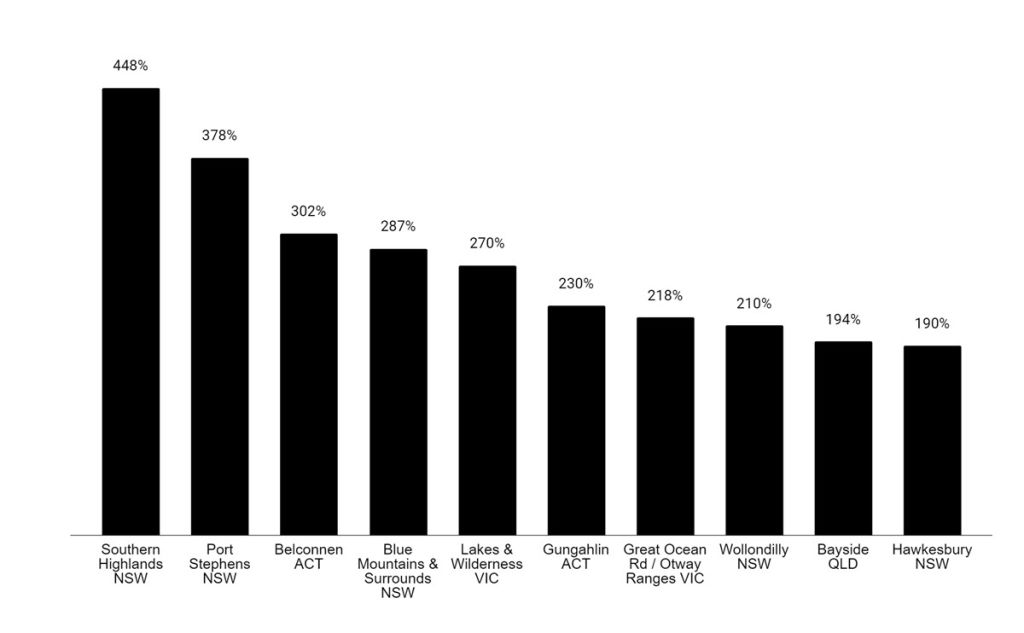

The above graph shows the top 10 regions for growth in leads from retail listings (sales and leasing) on commercialrealestate.com.au - Q1 2021 vs Q1 2020: only includes areas with more than 100 quarterly listings.

Shopping into the future

And, while retailers continue to work on having spaces customers want to come to, they’re also increasingly using data to find out what works.

“Data is probably one of the most exciting elements of our business today,” Mr Barnett said. “And, really having a detailed understanding of the way that our consumers change their behaviours is dictating to us how we evolve our shopping centres moving forward.”

For GPT properties — which include Melbourne Central, Highpoint and Rouse Hill Town Centre — this means using data analytics to assess how often customers shop, what they’re shopping for and then using that to decide which retailers they’re happy to have in those properties.

“Our retail mix is adapted around their consumer behaviour,” he said. “It also is a reasonably solid tool to allow us to prevent tenants to come into our centres that may want to be there, but really aren’t aligned to the customers within each of our trade areas.”

With all that, Mr Barnett is positive about the future for bricks-and-mortar retail: “We’re pretty confident that the retail sector will rebound back to its pre-pandemic levels by the end of this year.”

By EMILY WATKINS