Vietnamese

Vietnamese

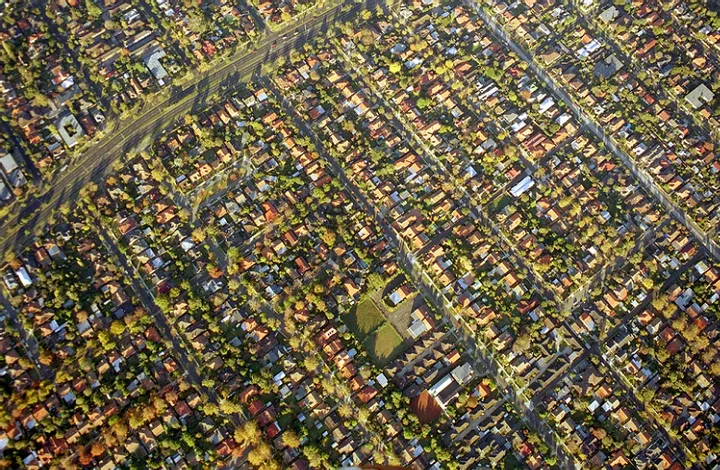

Overheated Market Cooling Buyers’ Enthusiasm

Home buyers are feeling burnt by the hot real estate market as the overall mood shifted this quarter.

Supply of properties available was one of the biggest problems reported by buyers in the report with 65 per cent of survey respondents believing “there isn’t enough choice”, according to ME’s latest Quarterly Property Sentiment Report.

This was particularly prevalent in regional New South Wales where 71 per cent wanted more choice compared to 57 per cent in the city areas.

Affordability was another key issue for the majority of respondents and 67 per cent expected house prices to rise further.

However, investors were feeling more positive—42 per cent of existing owners felt a greater “sense of wealth”, the highest level since the survey began in April, 2019.

Overall, the sentiment of buyers and sellers in the residential property market dipped 7 per cent to 42 per cent in the past three months according to the report.

Similar results were seen in REA Group’s insight report based on 12 million hits to realestate.com.au, where search activity dropped from historic highs and email enquiry was down for the third successive month.

The outlier was investor enquiries which moved 84.2 per cent higher than last year while first home buyers were up by just 0.7 per cent on April, 2020.

REA group director of economic research Cameron Kusher said the housing market was starting to show signs of slowing.

“Preliminary weekly sales volumes are still significantly higher than they were a year ago, but they have not yet returned to their pre-Easter high and look unlikely to do so before spring,” Kusher said.

This follows the record-high levels achieved the first quarter of 2021 driven by HomeBuilder stimulus, low interest rates and stamp duty relief in some states.

ME head of home loans and personal banking Claudio Mazzarella said the sentiment in the market had flipped since mid-2020.

“When property prices and interest rates lowered last year during the pandemic, a unique buying opportunity opened up for confident first home buyers with cash savings and secure employment, while many investors became nervous,” he said.

“Now that prices have rebounded strongly and affordability is going down, first home buyers aren’t feeling as positive.”

House price rises reached a record high during the March quarter surging to an average of $899,509 across the country according to Domain.

By RENEE MCKEOWN